35+ Financial rate of return calculator

0 State Taxes Deductible. On the surface it appears as a.

Donation Letter Donation Letter Template Donation Letter Fundraising Letter

For example you sell a pair of skates for 100 and accept a used pair of skates as a trade.

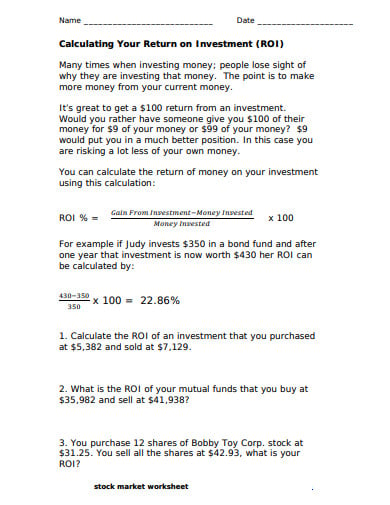

. For any typical financial investment there are four crucial elements that make up the investment. The average rate of return will give us a high-level view of the profitability of the project and can help us access if it is worth investing in the project or not. You give a credit of 35 for the new skates.

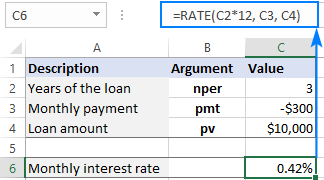

More Retirement More Dems propose raising taxes on high. 07012022 First Cash Flow Date. Return rate For many investors this is what matters most.

Simply enter the amount you wish to borrow the length of your intended loan vehicle. New investors may need money to buy a home and therefore might opt for a conservative asset allocation model. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return.

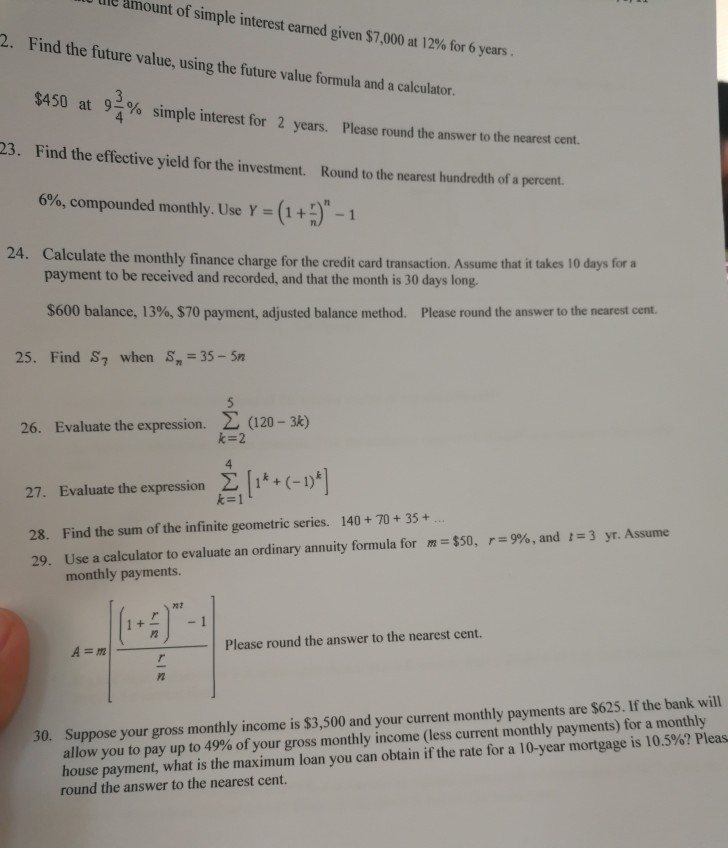

1 Adjust Cash flow for Inflation. Monthly Annual Inflation Rate. This can be useful to understand when the annuitys rate of return becomes positive.

Nevertheless for FY23 the average real GDP growth is expected to be around 7 or so. Present value is compound interest in reverse. 1st July 2022 Currently PPF rates are 71 for July September 2022 quarter.

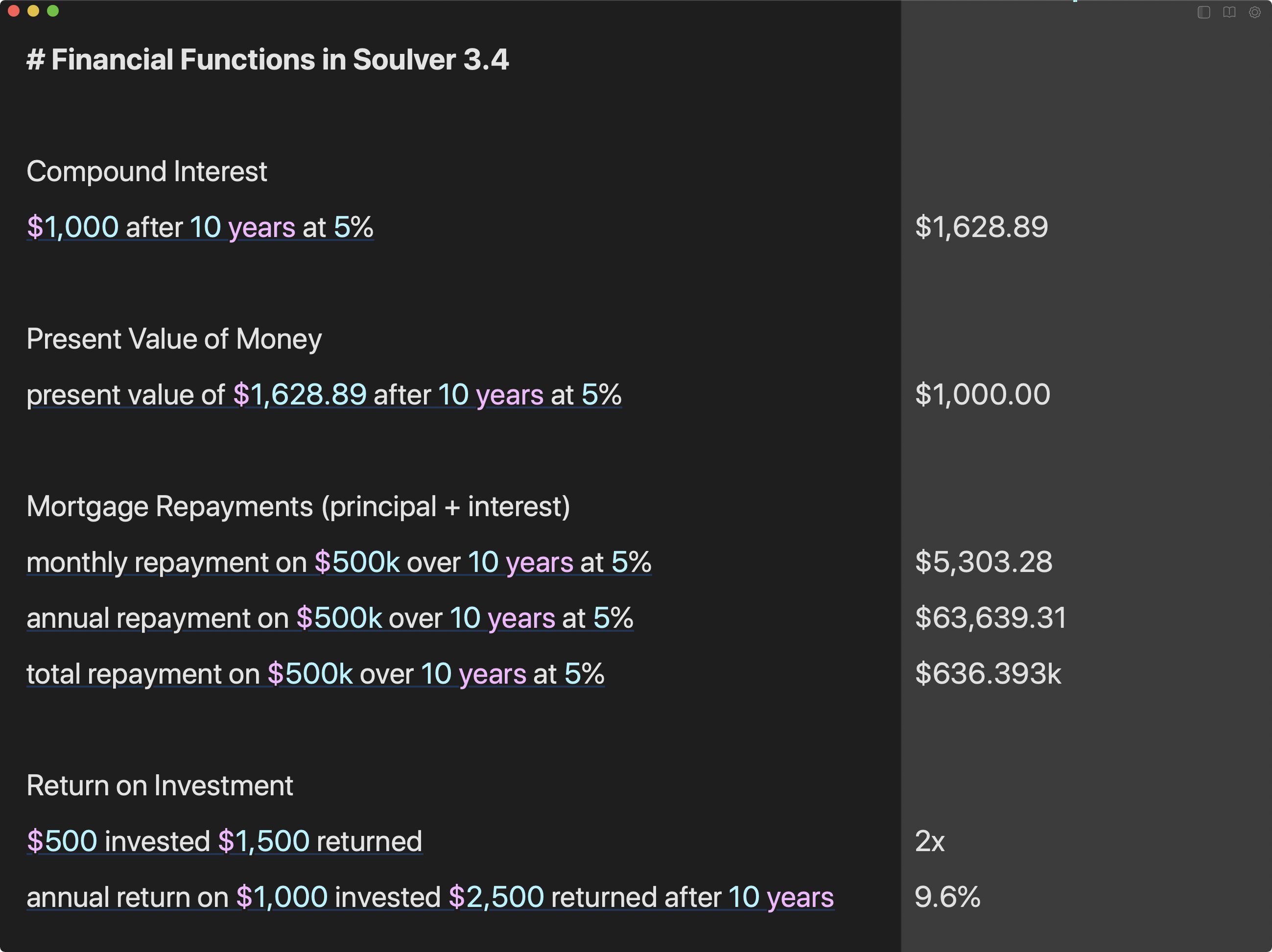

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Rates are influenced by the economy your credit score and loan type. Nationally 85 of small businesses experienced financial challenges in the last year according to the Small Business Credit Survey.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. Investment rate of return is the average return that you expect your investments to grow not adjusted for inflation. Here we discuss how to calculate Real GDP along with practical Examples Calculator and downloadable excel template.

Certain calculators will even take the rate of inflation into account to help you understand the value of your investment in the future. You have to include 100 in the total eligible sales for your net tax calculation. Annuity Rate of Return - A line chart that displays the rate of return from the annuity over time.

WACC is an important metric used for various purposes. Zero-rated supplies are supplies of property and services that are taxable at a rate of 0. Calculating Income Tax Rate.

These items are used to calculate the annuitys internal rate. Average Rate of Return 1600000 4500000. More conservative investments usually have a lower rate of return yield or interest rate.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Those who retire early need their portfolios to last 35 years and thus will keep a larger exposure to the stock market. No Federal Marginal Tax Rate.

The history of PPF interest rates is not very exciting. All this information will then be used to calculate what your returns will be. In terms of the outlook going forward we think the momentum in the second half of FY23 and into FY24 will be on the softer side because of the global headwinds.

Among other places its used in the theory of stock valuation. Average Rate of Return 3556 Explanation of Average Rate of Return Formula. Related Investment Calculator Interest Calculator.

Again these are general patterns. If the business can achieve or launch a project with a higher than this rate it is always preferred. If you file a paper.

The investment rate change happens on the date of the last contribution. Annual Rate of Return. These Investment Returns Calculator can also help you identify the best investment tools for your future financial goals.

Roth Conversion Calculator Methodology General Context. Asset allocation by age varies by individuals needs. 15 25 16 30 19 35 1520.

The data table has the year annual annuity payment and the final value of the annuity. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. The average return is defined as the mathematical average of a series of returns generated over a period of time.

Rates remained low until March 2022 when the US. The United States has a progressive income tax system. Finding the amount you would need to invest today in order to have a specified balance in the future.

Rates were last changed on 1st April 2020 onwards. In regards to the calculator the average return for the first calculation is the rate at which the beginning balance concludes as the ending balance based on deposits and withdrawals that are made in. This calculator uses 7 as a default Investment rate of return which is a relatively conservative assumption.

The emergency rate cuts brought the federal funds rate down to zero. See How Finance Works for the present value formula. It sets the tone clearly wherein it is the minimum hurdle rate or the lowest bar.

Therefore the calculator gives the user the option for two rates of return one for the pre-retirement investment and one for the after retirement investment. You can also sometimes estimate present value with The Rule of 72. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional rollover SEP andor SIMPLE IRAs into a Roth IRA but it is intended solely for educational purposes it is not designed to provide tax advice and. Historically the SP 500 has returned on average 10 annually from its inception in 1926 to 2018. Assume that the nominal GDP of the US was 11 trillion and in the year 2017 was 11 trillion and the inflation rate was 10.

The changes have been very rare Read More PPF Interest Rate History 2022 Update 35 Years History. No Taxes Calculated on Withdrawal. And a business must earn over and above this rate or this bar to remain in the business.

In turn a home with a market value of 500000 and consequently a 350000 assessed value and a mill rate of 50 would pay 17500 in annual property taxes. To calculate your tax based on your mill rate divide your assessed value by 1000 and multiply the result by your mill rate. Central bank raised rates for the first time since 2018 in response to.

A financial advisor can help you understand how taxes fit into your overall financial goals. Inflation tends to be negative for growth but the pinch in particular is seen in segments where real disposable. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

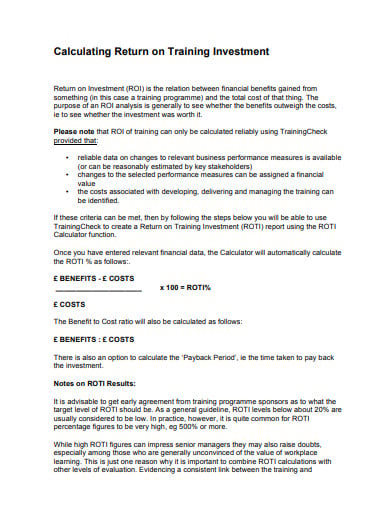

How To Calculate Return On Investment Roi

11 Return On Investment Calculator Templates In Pdf Excel Free Premium Templates

Using Rate Function In Excel To Calculate Interest Rate

How To Calculate Return On Investment Roi

Solved Lle Amount Of Simple Interest Earned Given 7 000 At Chegg Com

How To Calculate Return On Investment Roi

Soulver Soulver Twitter

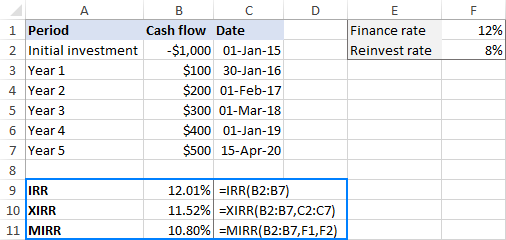

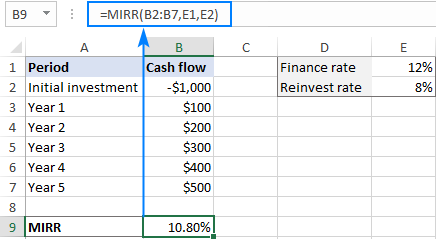

Irr Function In Excel To Calculate Internal Rate Of Return

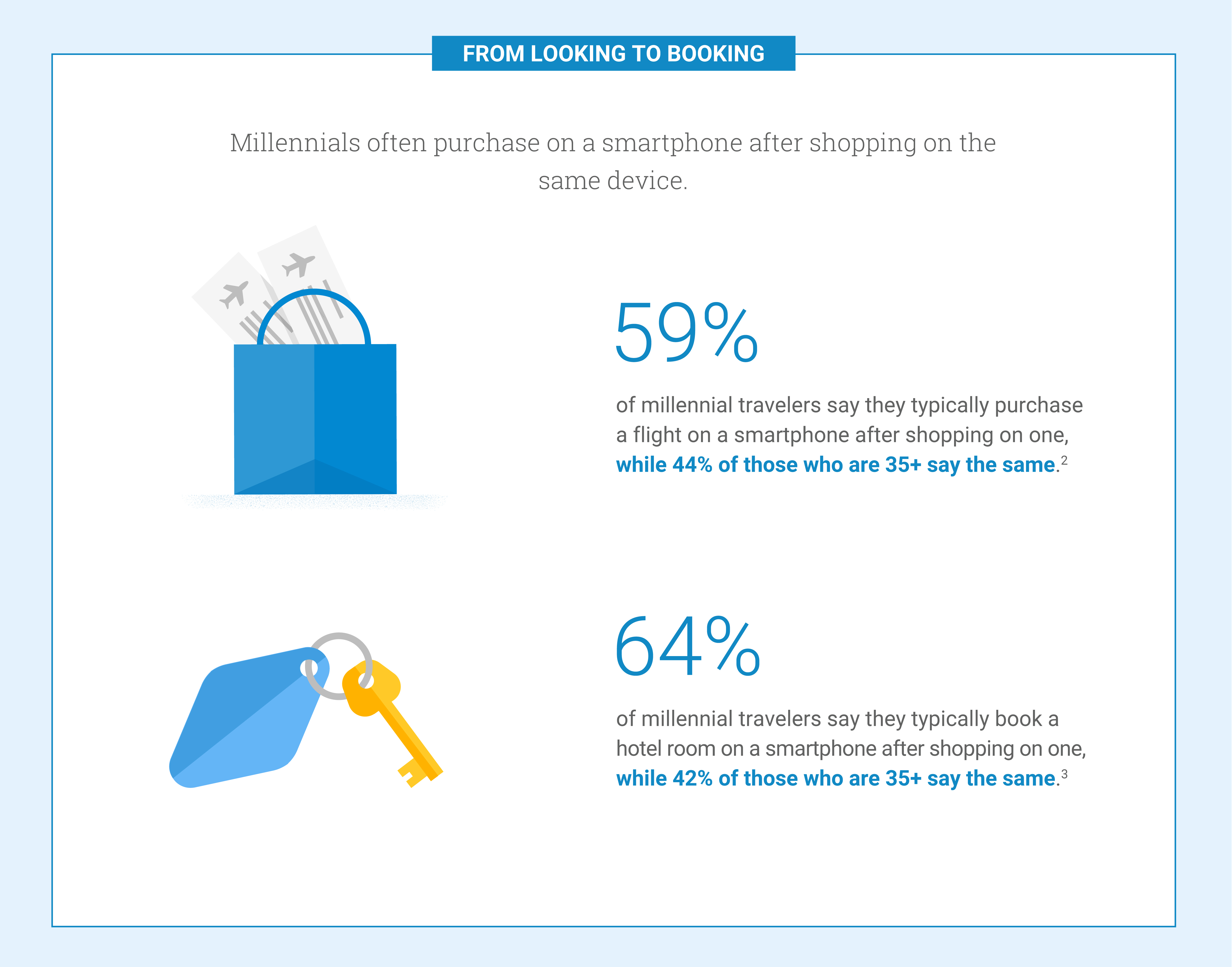

Ok Google 27 Percent Of Millennials Use A Smartphone To Shop For Hotels Hotel Management

Irr Calculation In Excel With Formulas Template And Goal Seek

Google Search Trick To Help Become Better At Online Search

Irr Calculation In Excel With Formulas Template And Goal Seek

How To Calculate Return On Investment Roi

Buy I Bonds In September 2022 At 9 62 Keil Financial Partners

11 Return On Investment Calculator Templates In Pdf Excel Free Premium Templates

Contribute To My 401k Or Invest In An After Tax Brokerage Account

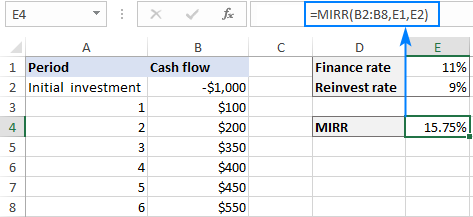

Excel Mirr Function To Calculate Modified Internal Rate Of Return